Mobile money has changed the way we handle transactions. Remember when we had to go through long lines in the bank before we could withdraw, transfer, and deposit? Now everything happens in seconds. Just a click from your phone at the comfort of your home, you can make payments, transfer money to people with no stress at all. But while it’s made life easier, it has also created job opportunities for many scammers. One of the sneakiest, and most annoying tricks making rounds today, is the fake mobile money pop-up.

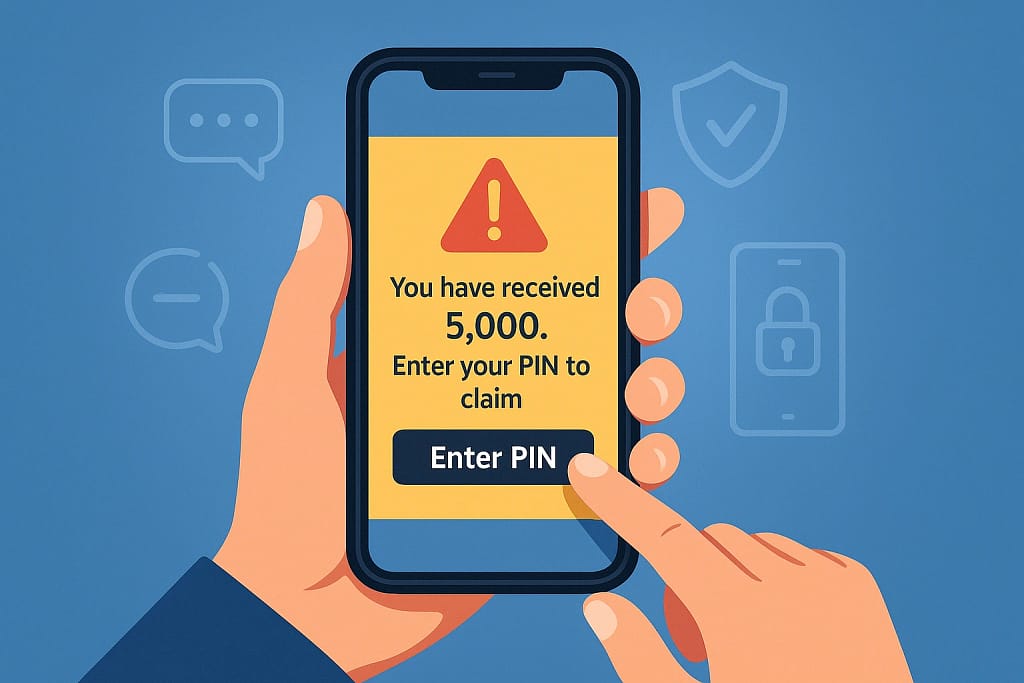

Pop- ups are on-screen messages designed to look exactly like genuine notifications from your bank or mobile money provider. They can show up while you’re browsing, making a call, or even when your phone is locked. At first glance, they seem harmless at first, until when you click, and suddenly your money or personal details are in the wrong hands.

Knowing how to spot these traps before you act is the difference between staying safe and becoming a victim.

In normal use, a mobile money pop-up looks like an official notification triggered by your provider. For example: When you send money, you get a confirmation, when someone sends you money, you get an alert, when you buy airtime or pay a bill, the system shows you a summary.

Read Also: The Hidden Trick to Learning Anything: Create the Problem First

These legitimate messages are handled inside your bank’s or mobile provider’s official system. They follow the design, they follow the same fonts, they follow the same colors, and they follow the same format every single time.

What could be the problem? How are they able to utilize this? Scammers have studied these messages down to the smallest detail. They create fake versions that look almost identical, but with one key difference is their goal is to get you to act without verifying.

How Scammers Push Fake Pop-Ups

Scammers can send these fake alerts in several ways. Just like…:

Through Random Apps: Some cloned or “free” apps carry hidden software that triggers fake notifications.

Via Web Browsers: Certain shady websites from your browsers push pop-ups disguised as payment alerts.

Through Malware: If your phone is infected, the malware can create pop-ups that look official but lead you to fake payment screens.

Imagine you are watching a YouTube video and suddenly a pop-up flashes, “You have received 5,000. Enter your PIN to claim.” You think it’s from your provider, please it is not. It is from a scammer waiting to steal your login.

How to Detect Fake Mobile Money Pop-Ups

Even the best fakes slip up somewhere. Here is what to watch out for:

1. Language Errors: Real banks invest in professional communication. If you spot strange grammar, odd punctuation, or spelling mistakes, take it as a warning. It is a scam!

2. Low-Quality Branding: If the logo looks blurry, colors look off, or images seem stretched, it is likely a copy.

3. Suspicious Sender Details: A real notification will come directly from your provider’s system. Unknown numbers or random email addresses are suspicious.

4. Urgent Threats or Promises: Phrases like “Your account will be closed in 30 minutes”, or “Claim your free cash now”, from your notification bar, are almost always scams.

5. Out-of-Place Pop-Ups

If you see a payment request while using an unrelated app or browser, treat it as fake, because it is. So long as you did not send a payment request, it is fake.

Here Is The Right Way to Verify Before Clicking

The best thing to do is to slow down and double-check. Here’s how:

Go to Your App Directly: Close the pop-up and log into your mobile money app. If the alert was real, you will see it in your transaction history.

Check Your Balance & History: If the pop-up says you have received money but your balance hasn’t changed, it’s fake.

Use Official Support Channels: Only call numbers listed on your provider’s website or official app, never those inside suspicious pop-ups.

Enable Security Your Features: Turn on two-factor authentication and set a strong PIN or password. This adds a second barrier against fraud.

But, If You’ve Already Clicked: Mistakes happen, and scammers know how to catch you off guard. If you’ve clicked:

Act Immediately: Log in and change your password or PIN.

Notify Your Service Provider: Ask them to freeze your account if there’s any sign of compromise. Do not let it slide. Act immediately.

Scan for Malware: Run a trusted antivirus or security scan to detect harmful apps. This is very important. Because virus may have entered your device.

Stay on Alert: For the next few weeks, monitor your account closely for suspicious activity. Do not forget to always check your email for any warnings.

Extra Tips to Stay Ahead of Scammers

Avoid Downloading Random Apps: Only get your apps from official stores like Google Play or Apple App Store, not from random links.

Turn Off Browser Pop-Up Permissions: Very important. Most fake alerts on websites rely on pop-up permissions to work.

Always Update Your Phone’s Security: Updates patch security holes that scammers love to exploit. Make sure to change your phone’s security password once in a while.

Educate other people: Scams spread because people do not talk about them. Share what you know. Do not keep the information to just yourself. Learn more from google security center

Related Article: This App Isn’t Available in Your Country? Here’s the Real Fix (No VPN Needed)

Scammers rely on panic and impulse. They know most people click before thinking. But the truth is, you do not have to be a tech expert to avoid them. You just need to pay attention. Real pop-ups from your mobile money provider will always match the style you are used to and will appear inside the official app, not out of nowhere.

If you take a moment to check the details, use your app to confirm transactions, and ignore anything that feels rushed or off, you will make it almost impossible for scammers to win. Staying alert is not just smart, it is how you keep your money, your data, and your peace of mind safe.